Have you ever wondered if a Crypto AI trading bot can really work on Binance? I took eight platforms for a whirlwind, the AI linked to Binance via the API (spot and future), and tested their basic characteristics, their flexibility of strategy and their ease of use. Here is what really stands out – and what looked like a media threw. Let’s dive into usable details so that you can choose the right bot ai that corresponds to your style.

What makes a Crypto AI trading bot that is worth trying?

When I say “bot”, I mean software that connects to the binance API, analyzes market data via AI or algorithmic logic, performs commands, manages the risk and – ideally – the 24/7 automata.

What really matters? Signal cling, strategy filters, risk control, backtesting, transparency and cost. Emotional control also – Bots help reduce the FOMO, but the cartography configuration must be solid.

⬇️ See the main Crypto AI robots

How I evaluated each tool

I looked:

- Basic characteristics: Types of strategy (grid, DCA, trend, model recognition), backtest capacity, portfolio view.

- Use case: Better for beginners, analysts, swing trading robots, price arbitration or future.

- Ease of use and configuration: At what speed of binance connection, configure the strategy.

- Value and price: Free or trial? Price vs features.

- Reliability and confidence: transparency, support, performance.

Best Crypto AI trading bot that works with Binance

1. Tickeron

Basic characteristics

- AI agents specific to ticks fueled by financial learning models (FLMS)

- Recognition of reasons on the signals of candlesticks

- Gen – 3 Multi -model strategies for crypto

Use case

Ideal for merchants by focusing on an asset (for example ETH / USDT) with a deep model analysis and a minimum parameter configuration.

Notice

Better still for beginners who want a model based on models. The configuration was trivial, but I noticed less flexibility in the personalization of the strategy. I felt reliable but limited to a concentration to a single workshop.

2. Intellectia

Basic characteristics

- Use XGBOOST + neural networks to scan news, feeling and technical models through crypto

- Provides swing trade signals and an entry / exit calendar guided by AI.

Use case

Ideal for traders who want swing strategies focused on several parts. Works well with Binance via webhook alerts or manual actions.

Notice

Better for active merchants who like decisions to support data. I found its signals consistent and detailed. Not completely automated, but a solid companion for commercial timing.

3. ATERNA AI

Basic characteristics

- Automated execution via webhook

- Trends detection

- Risk control modules

Use case

Suitable for users who wish an AI with automated execution, a low configuration to without code.

Notice

Promising if they integrate directly into the Binance API, but the lack of public information made me careful. A good potential adjustment for strategy automation fans.

4. Kavout

Basic characteristics

- Kai score and intelligent signals through crypto and stocks

- Investigpt interface to discuss the market

Use case

Useful for analysts who follow several assets and requiring signals with portfolio diagnostics.

Notice

Better for users who wish more than the automation of AI – signals rather than autonomous robots. Works by alert → Manual or Webhook to execute on Binance.

Basic characteristics

- CNoisy bots supporting DCA, GRID, Futures on Binance strategies

- Personalized models, Multi-Coin support

Use case

Perfect for all those who want plug-and play robots that operate continuously on Binance.

Notice

Strong conviviality; The configuration has taken minutes. Better for newcomers who wish automated executions with common strategies. I have limited but solid reliability.

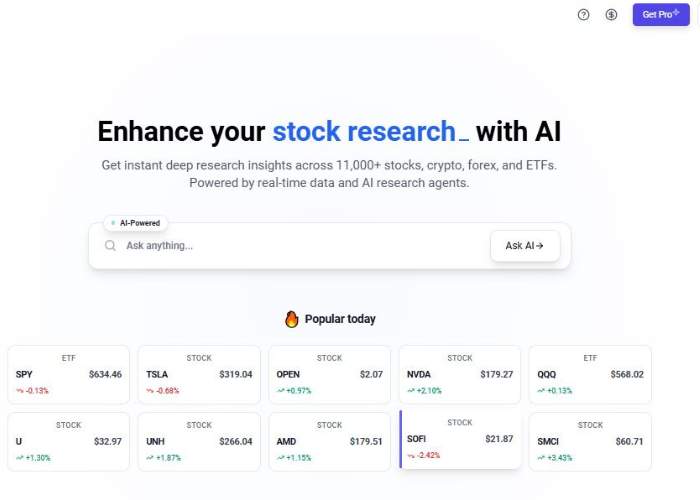

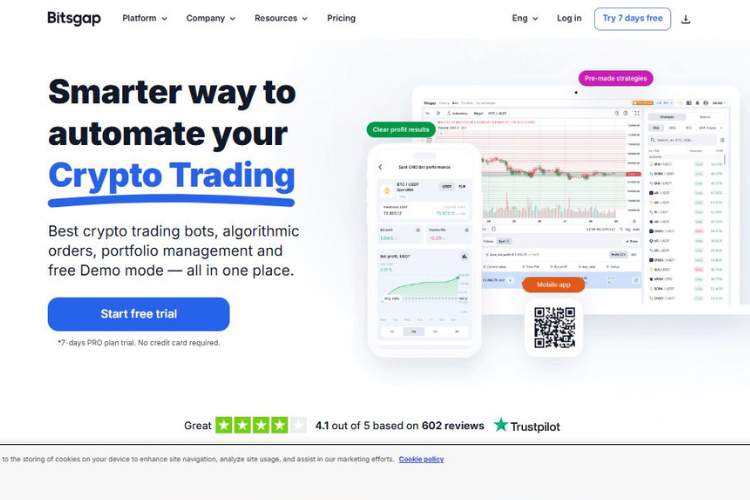

6. Bitsgap

Basic characteristics

- Several types of bot on Binance Spot & Futures (Grid, DCA, Combo)

- Backtesting, wallet monitoring, smart orders.

Use case

Good adjustment for merchants using several pieces and desire to manage the wallet plus bots in a dashboard.

Notice

Best conviviality + multi-exchange support. Their binance robots were robust. AI assistant's suggestions were correct but not revolutionary.

Basic characteristics

- Translated alerts (tradingView etc.) into binance orders in less than 0.5 s

- Automation based on webhook.

Use case

Excellent for users who code or configure alerts and wish to automate the execution without writing your own infrastructure.

Notice

Better to control the monsters that design their own signals. Not a bot with an AI strategy, but a bridge for execution alerts. Smooth connection to the Binance.

8. Tradedeas

Basic characteristics

- At the origin of the engine in stock / scan; Personalized digitization logic via Holly ™ AI

- Can send alerts to webhook systems (for example, Wunderrading) to perform on Binance.

Use case

Ideal for traders who like to build personalized analyzes and who then wish to automation via an external execution layer.

Notice

Best for users who want flexibility and advanced alert -based trading. Configuration more involved, but powerful once linked.

Comparison table

| Tool | Better for | Strategy types | Automation method | Pricing |

| Tickeron | Recognition of patterns on a single Ticker | Chandelier caps | Native binance api | Paid level; fixed model |

| Intellectual | Swing signals controlled by AI | Technical / feeling | Alerts → Manual or Webhook | Free tier + paid for signals |

| ATERNA AI | Automated entry / output rules | Trendy bots | Native boot | Info Limited; evaluate the trial |

| Kavout | Perspicious signal + portfolio tools | Signal notation | Alerts / manual | Affordable; Signals focus |

| Tradesanta | Bots Plug-et Play | Grid, dca, future | Native | The plans start low; Good value for money |

| Bitsgap | Multi-candlestarts and wallets | Grille, DCA, Combo robots | Native | Complete platform; multi-exchange |

| Signals stack | Alert execution bridge | User defined | Webhook automated orders | Pay by signal; lean |

| Trade | Advanced analysis → Webhook execution | Personalized scan | Alerts → External robots | Subscription; flexible use |

Conclusion and recommendations

After having tested everyone:

- Tradesanta Shine as best for users who want immediate binance automation: easy configuration, reliable robots / DCA / future, minimum leaflets.

- Bitsgap is a powerful, ideal finalist if you exchange several coins and want advanced bot types, a portfolio view and backtesting.

- Signals stack Win its place if you create your own tradingView or Trendspider strategies and need a coherent and fast execution, especially lean and profitable.

Honorable mentions::

- Tickeron is the easiest for motive signals in ounces.

- Intellectual Provides thoughtful swing ideas.

- Kavout Offers smart signals through wallets.

- Trade In addition, external execution tools give maximum flexibility if you create your own alerts.

So if you specifically test a Ai Crypto Trading Bot that works with BinanceGo with Tradesanta or Bitsgap for full automation, and consider the signal if you are already creating personalized strategies. Everyone has their strengths according to the amount of practical control that you want in relation to the strategy you want to automate.