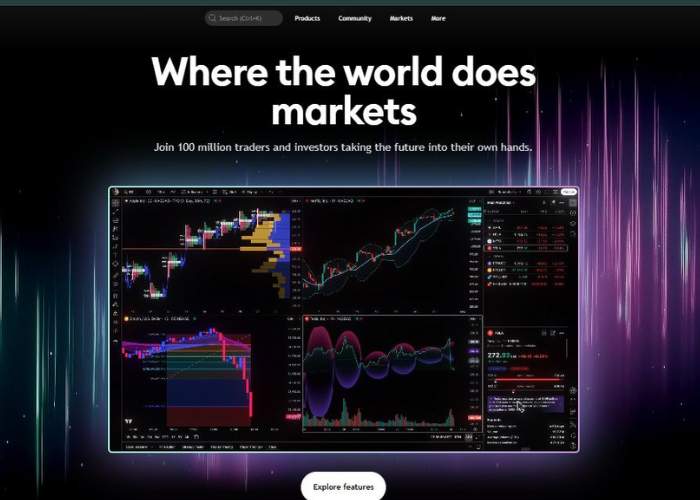

You register for Tradingview Think that these are “graphics”, but quickly find out that it looks more like a commercial operating system. Not an A -Bot in the classic sense – it's more like a bot launch. You build strategies in the pine script, jostles and shooting alerts that you can make lines in execution systems. Do you still have adrenaline pumping?

What exactly is tradingview?

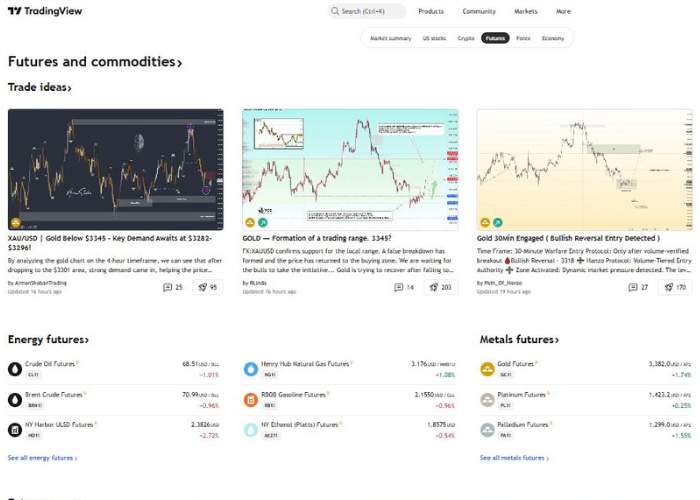

TradingView is mainly a Cartography and strategy development platform—Utilized through actions, crypto, forex, products, indices – offering backtesting, scripts, community code and real -time alerts. It does not execute transactions itself, but is closely integrated into the third-party bot services via alert webhooks.

So yes, it is a tool to build and validate your AI style strategies – but execution lives elsewhere. Imagine tradingView like the machine room where the data responds to decisions, and robots outside the trigger orders when the conditions are met.

Functional visit: what it brings (and leaves aside)

- Pin Script Strategy Builder

Write or modify strategies using integrated or personalized code – RSI crossovers, MacD triggers, candle patterns, you call it. Backtest directly on the graph. - Alert system with webhook support

You define the conditions, integrate URL Webhook and payload format – Integration platforms and then act on alerts to execute real professions. - Community and market

Tons of scripts and shared strategies. You can import community tools, read comments and adapt them. Great crowd intelligence. - Paper trading simulator

Run your strategies in demo mode before risking real money – useful for debugging and strengthening confidence. - Data integration and broker

Access real-time historical data and log in with brokers via third-party tools such as Tickerly, Cornix, Wuandertrading, Traderspost, etc.

My trip: from configuration to trades (almost) live

I started to scratch a simple Multisel pine script strategy, I traveled it through the backtest – it seemed promising. This buzzing of graphics becoming green? Invaluable. Then, I set up an alert with a webhook to a trial boot supplier. Set it on paper.

First week: triggered alerts, registered exchanges. Paper p & l? Meh – Small Pips here, tiny losses there. I felt like led a ship through the fog: promising, but trying for the nerves when the blows have dried.

Then, the community script that I borrowed reported an inversion candle model which coincided with a sudden movement in ETH. I saw the alert, I jumped in myself – not entirely automated. This small 2% movement on paper looked like a validation. Emotional high.

But alerts were poorly turned one morning (bug in my code), which made me move on to a spiral in the debugging of the strategy. The community forums were rescuers – someone had the exact fix. It is empathy in the Terre code.

Table of advantages and against

| Pros | Tales / warnings |

| Super powerful pine script editor + backtesting | Steep learning curve if you do not code or script |

| Community and massive strategies | Non -native execution – External bot services are necessary |

| Supports multivariate strategies, alerts, a detailed logic | Alerts and scripts often behind wage wall levels |

| Live graphic paper and graphic simulator | No direct trade execution function |

| Works in several asset classes worldwide | Risk of over-optimizing strategies on past data |

What does that do

There were mornings, I woke up for alerts that pinging my phone – helped as control of the mission. Other times, nothing was dismissed all day and I set up the configuration. Emotional swings – Organization of frustration.

See P & L Zero Out or Go Red hit me stronger than expected. However, the scripts debit – code package after a false alert – were strangely satisfied. It is proud to iron bugs, to see your logic catch a break.

Price and value

TradingView has several level subscription plans. The free level gives basic mapping; Paid levels unlock alerts, multiple chassis strategies, extended data, the amount of alert. No direct trade automation cost, but you will pay bot services separately. Platforms like Tickerly or Cornix begin ~ 19–39 $ / month after the tests (turn0search13, turn0search2)

Combined, the price is reasonable – you control expenses by mixing the construction of strategies on tradingView with a separate execution layer.

Final verdict (my two hundred)

Tradingview Is it not an a-hand-hand a-handbot-it's the canvas where you design your bots. If you are cool with the writing or adaptation of strategies, test them and connect to external execution tools, this platform is in gold. It doesn't do everything for you, but it allows you to do most.

If you expect a bot solution without an in-one, you will have to look elsewhere or build the missing parts.

Suggested use approach

- Master Pine Script via small scripts.

- Backtest with strategy tester; Debug reported problems.

- Define alerts with a webhook format and an appropriate payload.

- Use trusted third -party automation services (Tickerly, Cornix, Traderspost).

- The paper trade is largely before putting online.

- Monitor the newspapers, follow performance, refine the strategy periodically.

Conclusion: Should you use tradingView?

Yes, if you are ready to learn the scripts, test carefully and manually complain about the execution. It becomes powerful in good hands: a precision tool for traders who like to build rather than being given a black box.

Do you want to help make a pine script model or configure useful alert loads for a webhook? I am happy to help map it.